Excellent software and practical tutorials

How to apply for a virtual credit card in China?

No overseas identity required.Virtual Credit Card ApplicationAs the potential of cryptocurrencies becomes increasingly popular among merchants, cryptocurrency debit and credit cards have recently emerged, making it feasible to use cryptocurrencies to pay in stores and restaurants. They provide consumers with a convenient experience of using cryptocurrencies such as Bitcoin, USD, Ethereum, etc. for daily transactions, which is no different from using traditional debit or credit cards.

What is a Virtual Credit Card?

Virtual Visa cards can provide you with a safer payment method because they are composed of a set of randomly generated numbers that represent your Visa card or bank account, without exposing your real information. Thieves cannot use these numbers to obtain your information or your funds. Therefore, more and more businesses are starting to use virtual Visa cards as part of the payment process.

Virtual VISA cards do not have physical cards, but have VISA credit account, issuing bank, card number, CCV and other information, providing safe and reliable 24-hour non-stop service, and can be used for electronic payment, online shopping, virtual recharge and other shopping activities.

Virtual VISA cards have many advantages, such as using advanced financial technology to provide safer and more convenient services. In addition, its real-name authentication is simpler and can effectively prevent fraud, thereby protecting the rights and interests of consumers; in addition, users can also save the tedious and time-consuming steps of real-name authentication, greatly reducing the burden on users.

What are the usage scenarios of virtual VISA cards?

- Overseas advertising expenditure: can be paid by binding a virtual cardFacebookAdvertising fees,Googleadvertise,Tiktok Ads and other overseas advertising costs.

- Dropshipping orders: In addition, for sellers doing Dropshipping, it is very convenient to bind a virtual card to place orders on e-commerce platforms such as AliExpress. If it is a domestic credit card, the probability of being rejected is very high.

- Monthly rental deduction for overseas e-commerce software: The monthly rental deduction required by e-commerce, such as shopity, shopmaker, siteground, etc., or the monthly rental of some tool websites, can be bound to a virtual card for deduction. Of course, we need to recharge the full amount into the balance of this virtual card every month.

- Free trial pre-binding of overseas tools: Many overseas tools will provide a free trial opportunity when registering, but many of them require you to provide a credit card information for deduction when applying, so that you can directly deduct the fee when entering the official package after the free trial. Many people directly bind domestic credit cards, forget to unbind during the free period, and are charged in the end. This happens frequently.

- Register various types of overseas accounts: To register a US PayPal account, you need a card for verification. Then we can generate a virtual card with custom information and use this card directly for verification.Apple IDBind the card, register a US Nitendo account, purchase games after binding in the US eshop, etc.

- Overseas shopping: When shopping in bulk overseas, the most common problem is order cancellation, which is mostly caused by credit card rejection. Some platforms do not support non-local credit cards. At this time, we need overseas virtual cards to help us complete the shopping, which can greatly reduce the chance of order cancellation.

- Overseas travel consumption: It can be used in online hotel booking and various online booking consumption scenarios. Some domestic platforms support bindingOverseas credit cardsEveryone can use virtual cards to make purchases, although there is a certain handling fee.

Today I recommendVirtual Credit Card(VISA) card opening platform——Chainge Finance,oneDecentralized multi-chain and cross-chain trading platform(supportiosandandroidsystem). It is very suitable for "crypto people" who have digital assets or "crypto new users" who want to experience virtual credit card (VISA) consumption in China.Don't climb over the wall(VPN),alsoNo overseas identity required, on mobile phoneAPPJust go upApply for and activate a virtual credit card with one click(VISA)——Chainge VISA Card.

Introduction to Virtual Credit Card (VISA) Card Opening Platform——Chainge Finance

Chainge Finance is a leadingWeb3.0 eraDecentralized multi-chain cross-chain aggregation trading platform, supports iOS and Android dual systems, with leadingCross-chain aggregation technology, currently supports more than36 chains (EVM and non-EVM chains), online more than1500 crypto assets, aggregate liquidityUp to 70 billion US dollarsChainge not only providesDEX spot trading,Cross-chain roaming(New cross-chain technology that is faster, more convenient and cheaper than cross-chain bridge transfers),VISA CardandHardware cold walletIt has many functions and is a DeFi cross-chain project that realizes a one-stop experience of Web3.0, demonstrating its first-class position in the market.

Chainge Finance released a new product announcement through its official Twitter account in January, launching the Black Label Package, which includes the Arculus hardware cold wallet card under Campo Secure (the world's largest metal bank card company) and a cryptocurrency-basedChaine Visa Card(The focus of this article).

Chainge Finance released a new product announcement through its official Twitter account in January, launching the Black Label Package, which includes the Arculus hardware cold wallet card under Campo Secure (the world's largest metal bank card company) and a cryptocurrency-basedChaine Visa Card(The focus of this article).

What is the Chainge VISA card?

Chainge VISA card is a virtual credit card issued by Chainge & Visa. Like other virtual credit cards, you first need to load U in and then convert it into US dollars for spending. But unlike other platforms, Chainge VISA card is built into the Chainge App. Users canNo need to climb over the wall,No overseas identity required, you can apply for activation and use directly on the mobile APP.

Chainge has a strongCross-chain roamingandMulti-chain cross-chain aggregation DEX function, can provide users with convenient services, allowing them to easilyMore than 1500Digital assets are transferred from 36 chains to the Chainge App andAggregate DEXExchange for U with one click, and then top up to your Chainge VISA card for consumption.

Chainge VISA card top-up fee is0%, is currently the onlyNo recharge feeVirtual VISA card, transaction fee is only1%It supports consumption in more than 60 million online and physical stores in more than 200 countries around the world, and supports binding with more than 30 domestic and foreign payment platforms, including Alipay, WeChat Pay, Meituan, PayPal, Google Pay, Visa, and local payment methods in many countries/regions.

Frequently asked questions

1.Can people with mainland Chinese citizenship apply?

Yes, you can apply with your domestic identity and use it globally.

2. Is VPN access required?

No, just download the Chainge APP and register.

3. Will KYC verification fail?

Basically no, the KYC certification procedure of Chainge VISA card is simple and the review is fast. (According to user experience, it is easier to pass if the age is over 22 years old)

4. What is the credit limit of Chainge VISA card? What is the daily spending limit?

There is no upper limit on the recharge amount, and the daily spending limit is $20,000.

5. Are there any requirements for the credit amount?

Minimum credit amount: 100 USD (update the App to the latest version)

6. How to pay by credit card?

No transfer is required, no handling fees are charged, the balance of the Chainge VISA card = the recharged USDC (it doesn’t matter if you have other currencies or stablecoins, Chainge’s built-in DEX supports more than 1,500 token transactions, which can be converted into USDC with one click)

7. What currency is used for card payment? What is the handling fee? What is the exchange rate?

USD, bank fee 1%, exchange rate is calculated based on the USD exchange rate of the day.

8. Debit or credit card?

credit card.

9. Scope of use?

- It can be bound to domestic Alipay (can scan the code or scan the gun to pay offline), WeChat Pay (can scan the code or scan the gun to pay offline), Meituan (can order takeout, Dianping group purchase), and foreign PayPal and Google Pay;

- It can be used on online platforms such as Meituan Waimai, Dianping, Taobao (virtual goods can be purchased after 2-3 days of card maintenance), Pinduoduo, Amazon e-commerce, Amazon Cloud, Google Store, Apple Store, etc.

- After I activated this card, I bought high-speed rail tickets during the Chinese New Year, shopped at Sam's Club, ordered coffee offline, booked hotels when traveling to Southeast Asia, shopped on Taobao, and recharged my card at an offline beauty salon. I chose to use the Chainge VISA card for all of the above transactions without encountering any problems.

(Virtual cards generally have a card maintenance period, which is basically about 3-7 days. During the card maintenance period, you can use Meituan to order takeout, group buy Dianping packages, and other physical consumption. Try not to cash out or buy virtual goods in the early stage of card maintenance. You can make normal purchases after the card maintenance is completed.)

10. How to activate the Chainge VISA card?

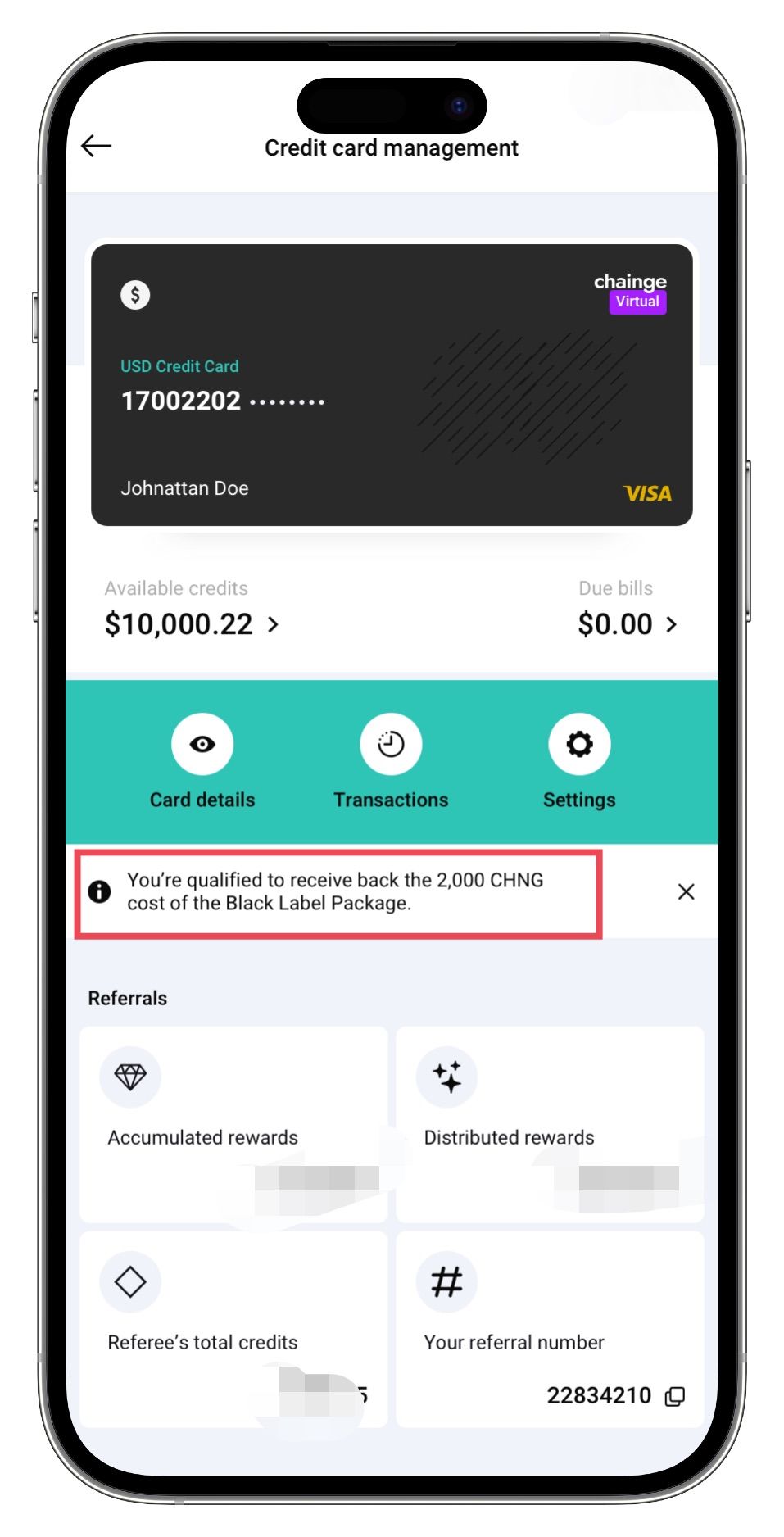

Currently, the Chainge VISA card is provided free of charge to Chainge Supreme users as an accessory. The only way to become a Supreme user is to apply to purchase the limited Supreme Black Label Package (Black Label Package), worth 2,000 CHNG. The package includes a customized Arculus hardware cold wallet, and in 2023, if you use the Chainge VISA card to recharge 5,000 USD or more, you can get a refund of 2,000 CHNG.

(In fact, 2000CHNG is equivalent to buying a customized Arculus hardware cold wallet, because hacking incidents are frequent now, and hardware wallets can fully guarantee the safety of funds. Hardware wallets are similar to bank U shields, which lock the assets on the chain. As long as the VISA card is used more, the 2000CHNG official will return it)

Preparation before applying

1. Download the Chainge Finance APP and register an account;

(iOS requires an overseas account. If you don’t have one, you can go to Taobao and check it out. It only costs a few dollars. Android system can directly scan the code to download)

2. Prepare 2000 CHNG in Chainge wallet

3. Fill in the "Hardware Cold Wallet" delivery information

Open Chainge wallet APP ➢➢➣ Click on the homepage Credit card ➢➢➣ Start here ➢➢➣ Ordering instructions, click Continue after reading (2 times) ➢➢➣ Fill in the Arculus hardware cold wallet delivery information (expected to be shipped at the end of the first quarter of 2023) ➢➢➣ Click Continue after completion

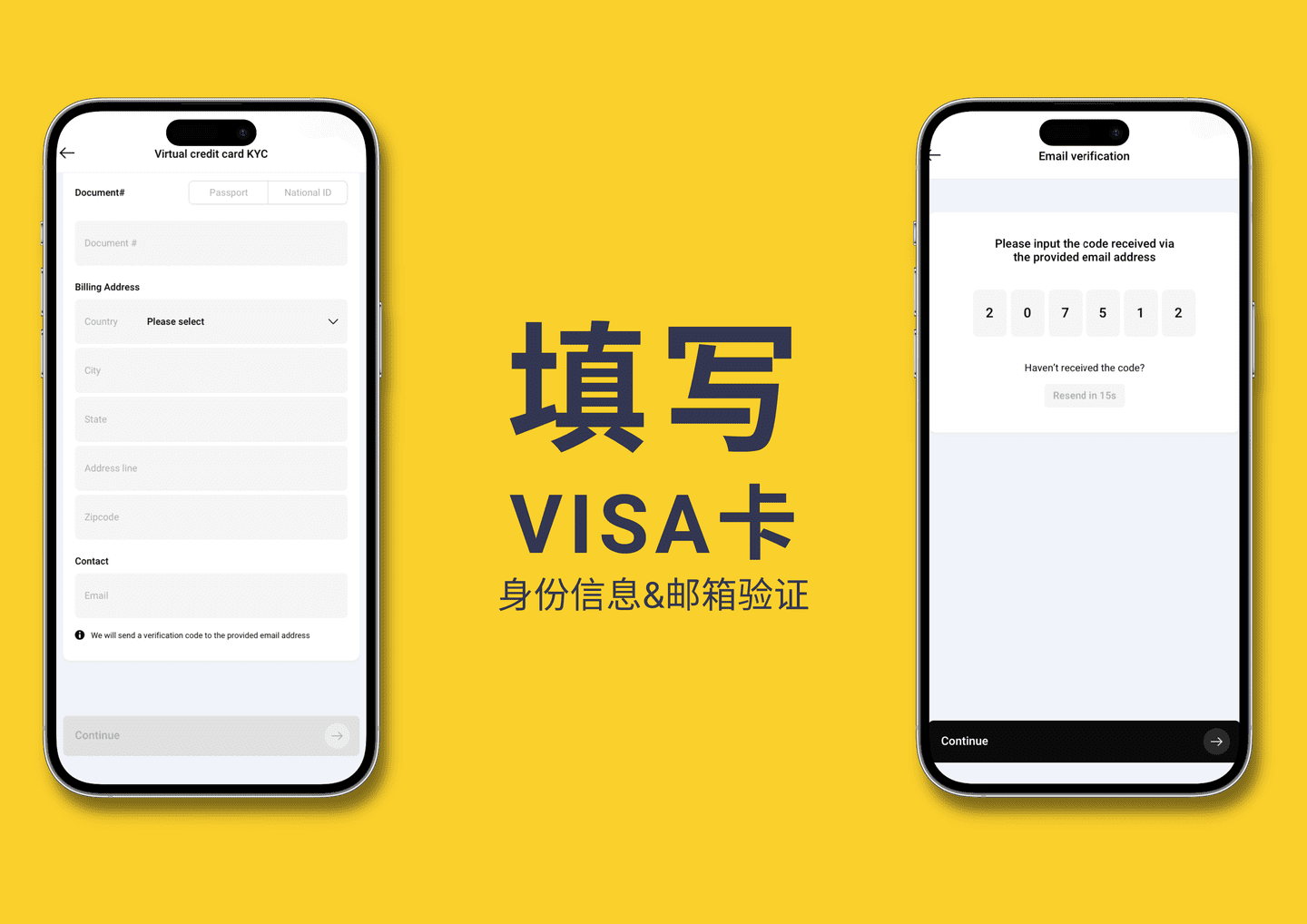

4. Fill in the Chainge VISA card

「KYC」Information Fill in your KYC information (no need to upload ID card and face recognition!!!) ➢➢➣ Verify email address ➢➢➣ Click after completionContinue

5. Submit an application to purchase the Black Label Package

Click Pay now ➢➢➣ Enter password to complete payment ➢➢➣ Wait for review result

Activate Chainge VISA card

1. Click Manage of your Chainge VISA card on the App homepage ➢➢➣ Click Top-up ➢➢➣ Enter the amount of USDC to be credited

(1USD: 1 USD, no handling fee in between)

2. Check the Chainge VISA card information, save the CVV, and start binding the card for consumption

Chainge VISA Card Usage Scenario

I have been using it for about a month now. It takes 3-7 days to maintain this virtual credit card. If you don't maintain the card and directly swipe it for large amounts or buy virtual goods, you may fail. After maintaining the card, you can directly shop on Taobao Tmall, offline shopping, massage, etc.

During the card maintenance period, there is no problem with binding Alipay for payment. However, Alipay will charge a service fee of 3% for orders over 200 yuan. This has nothing to do with Chainge. For example, an order of 220 yuan will cost 226.6 yuan. However, there is no service fee for Meituan Takeout.

After opening the card, you must remember to maintain the card, which takes about 3-7 days, depending on your luck. Some may be faster, while others may be slower, which is also normal.

1. The following is my personal experience of maintaining the card (first 3 days):

- Bind Alipay to buy "Australian Beef Coupon" at Sam's Club

- When I recharged my phone bill on Alipay, I got a random discount of 0.01, hehe.

- Bind to Meituan and order takeout (strongly recommend binding to Meituan to order takeout! Meituan payment does not have any service fees)

2. I personally tested the consumption records after maintaining the card:

- Physical beauty shop top-up (for girlfriend)

- Taobao payment

- Bilibili membership automatic renewal

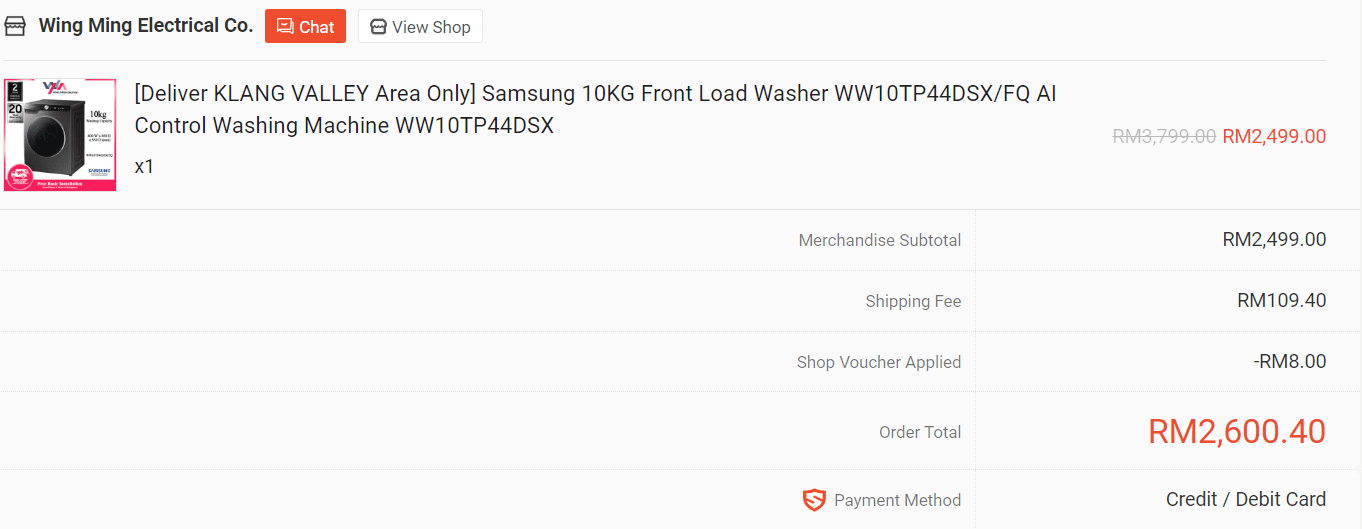

- Buy washing machines on Shoope with Chainge VISA card

3. Binding successful: Alipay (available, card needs to be maintained)/Meituan (strongly recommended!)/WeChat (strict risk control, not recommended)/Google Pay (recommended)/Pinduoduo (recommended)/Amazon (recommended)

4. Failed to bind Apple Pay/Cloud QuickPass

Horizontal comparison of four encrypted virtual cards

The following is a horizontal comparison chart of the four crypto virtual cards on the market: Chainge Card, Binance Card, Coinbase Card, and Depay VISA. This is compiled based on the official website’s public data, community user cases and other data information:

Chainge Card: Credit card, directly use the USD balance in your wallet to exchange for USD for consumption.The exchange rate is 0%. It is strongly recommended for users in mainland China to apply, with extremely low fees, the highest daily spending limit, and no upper limit on the card limit. The built-in cross-chain aggregation DEX supports 1,500 digital currency transactions and supports 19 chains (Tron,ETH, BSC, OEC, OP, Arb, etc.) can fully meet the needs of all "crypto people", and even novices can easily operate it (BSC and OEC have lower fees and faster arrival).No need to upload ID card or facial recognition, which can completely protect personal identity privacy!

Binance Card: Debit card, directly use the digital currency in the wallet to exchange for euros. Currently, it does not support applications in mainland China. The overall fee is low, but the daily consumption limit is the lowest, and there is no upper limit (account balance = limit). It currently supports 15 digital currency exchanges.Cryptocurrency exchange rate: 0.9%, you must undergo KYC2 level authentication (upload ID card, face recognition) before you can apply for use.

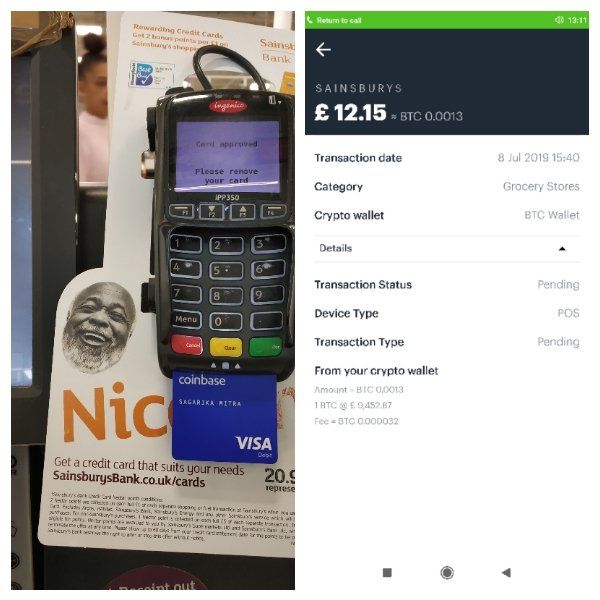

Coinbase Card: A debit card that allows you to directly use the digital currency in your wallet to exchange for British pounds. This card does not currently support applications in mainland China, and the fee standard is similar to that of Binance, with no card opening fee, monthly fee, or annual fee, butThe digital currency exchange rate is as high as 2.49%, currently supports 6 digital currencies, and KYC Level 2 certification (i.e. uploading ID card and facial recognition) is required before applying for use.

Depay VISA: Debit card, requires recharging USD before use (only supports TRC20 chain). Five types of card services are provided to users in mainland China, among which the lowest level card fee is 2 USD per month, the daily consumption limit is only 1,000 USD, and the monthly limit is limited to 1,000 USD. ** When recharging USD, the rate reaches 1.35% (** that is, recharging 1,000, the actual amount received is only 998.65), and an ID card must be provided and face recognition must be completed before applying for use.

Comparison summary:

- Chainge Card is a credit card that can directly use the USD balance in your walletExchange USD for consumption,The exchange rate is 0%, and supports USD transactions on 19 chains (Tron, ETH, BSC, OEC, OP, Arb, etc.),Cross-chain roaming transfer,No need to upload ID card and face recognitionAnd other advantages.

- Binance Card is a debit card that uses digital currency in your walletExchange Euros for consumption, the rate is low, but the daily consumption limit is the lowest and must beKYC Level 2 Certification.

- Coinbase Card is also a debit card that allows you to use digital currencies directly in your wallet.Exchange pounds for consumptionHowever, due to the high cost, it is generally not cost-effective.

- Depay VISA is a debit card that needs to be topped up with USD before use. It also requires providing an ID card and completing facial recognition procedures, and has a limited spending limit.

No matter which virtual card you choose, remember to use it after activating the card.Small purchases(Quickly accumulate trading activity)Card MaintenanceFor example, randomly buy 1-2 dishes on Dianping; order takeout a few times on Meituan; bind Alipay or WeChat to recharge phone bills a few times, etc.

Finally, I hope that the above introduction can help you fully understand the advantages of virtual cards, allowing you to easily enjoy using them, with more choices and more flexible payment methods!